- Home

- About

- Page

- Photo Gallery

- Testimonial

- FAQ

- Pricing Table

- List of Prohibited Goods

- Shipping Quote Online

- canada coureir

- Australia courier

- uk courier

- USA courier from India

- Our Bangalore Branch

- uniex courier overview

- Our Mumbai Branch

- Our Madurai Branch

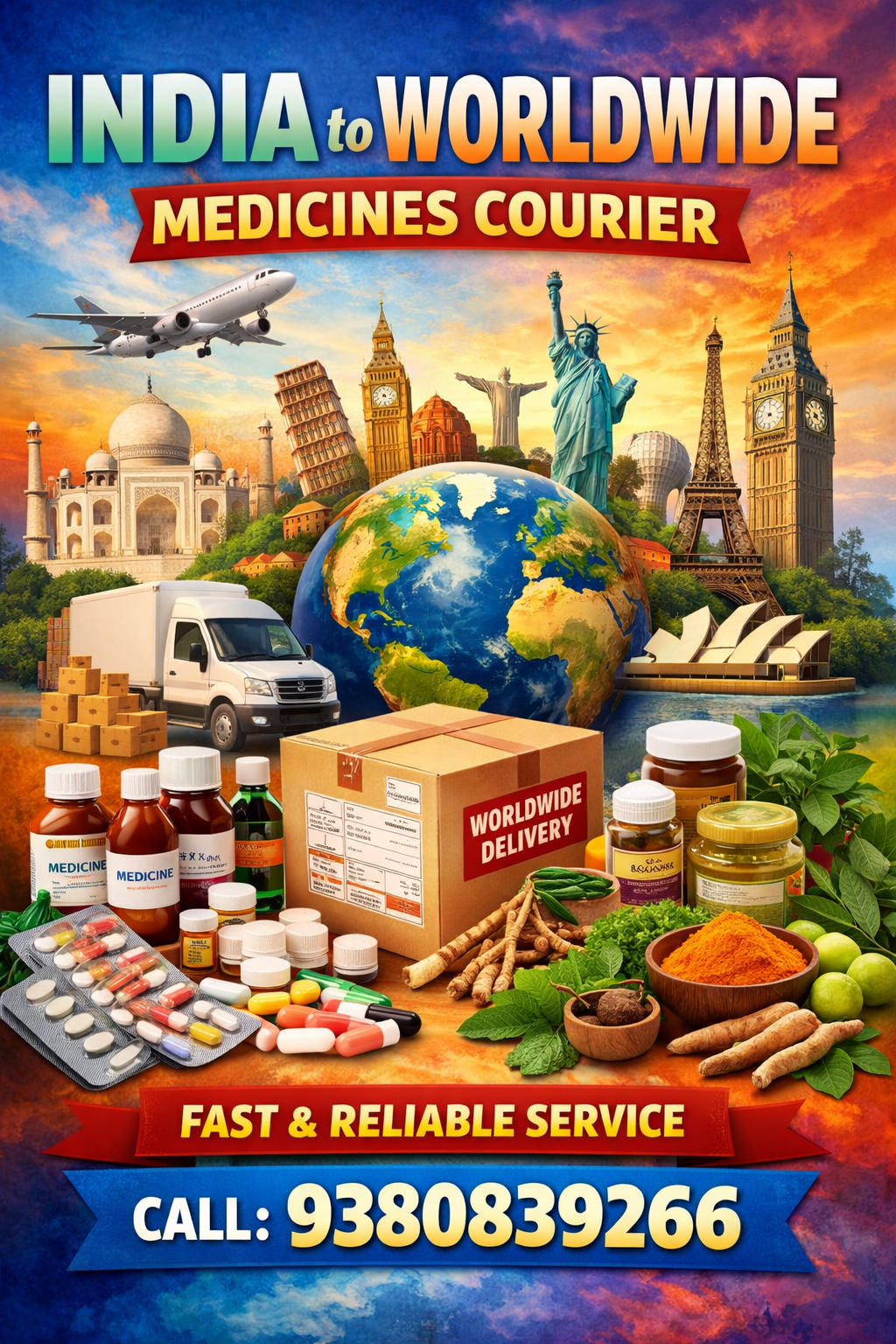

- International Medicine Courier from Chennai

- International Courier Services in Tirunelveli

- International Courier Services in Salem

- International Courier Service in Ariyalur

- International Courier Services in Chengalpattu

- International Courier Service in Cuddalore

- International courier Services In Dharmapuri

- International Courier Service in Dindigul

- International Couriers Services in Erode

- International Courier Services in Kallakurichi

- International Courier Service in kancheepuram

- International Courier Service in Karur

- International Courier Service in krishnagiri

- International Courier Service in Mayiladuthurai

- International Courier Service in Nagapattinam

- International Courier Service In Kanyakumari

- International Courier Service in Namakkal

- International Courier Service in Perambalur

- International Courier Services In Nagamalai Pudhukottai

- International Courier Service in Ramanathapuram

- International Courier Service in Ranipet

- International Courier Service in Sivagangai

- International Courier Service in Tenkasi

- International Courier Service in Thanjavur

- International Courier Service in Theni

- International Courier Service in Thiruvallur

- International Courier Service in Thiruvarur

- We can Pickup and Box Packing

- International Courier Service in Thoothukudi

- International Courier Service in Tiruchirappalli

- International Courier Service in Tirupathur

- International Courier Service in Tiruppur

- International Courier Service in Tiruvannamalai

- International Courier Service in Nilgiris

- International Courier Service in Vellore

- International Courier Service in Viluppuram

- International Courier Service in Virudhunagar

- Uniex International Courier Services from India to the USA

- International Courier From India To Dubai

- International Courier From India To Uk

- Uniex International Courier Services: Your Premier Choice for Shipping from India to Canada

- International Courier from india to singapore

- Competitive and Reliable Courier Charges from India to Europe | Uniex International

- Courier To Australia From India

- International Courier to Srilanka

- International Courier Services In Chennai

- Courier Service from China to India

- COURIER SERVICES FROM USA TO INDIA

- Best Courier Service From Uk To India

- Best Courier From Canada to India

- Best courier services from Australia to India

- Courier Service Hong kong to India

- Courier Services from Europe to India

- Send Courier From Singapore to India

- Courier Service to Send Parcel from Taiwan to India

- international courier services in mumbai

- International courier services in Delhi

- International Courier Services in Kolkata

- International Courier Services in Hyderabad

- International Courier Services in Bangalore

- International Courier Services in Visakhapatnam

- International Courier in Vijayawada

- International courier services in Nellore

- International Courier In Khammam

- International Courier In Warangal

- International Courier Service In Kurnool

- International courier services in Anantapur

- International Courier Services In Mahaboobnagar

- International courier services in Rajahmundry

- International Courier Services In Kakinada

- International Courier Services in Tirupati

- International Courier Services in Chittoor

- International Courier Service in Guntur

- International Courier Services in Mangalore

- International Courier Services in Cochin

- International Courier Services in Calicut

- International Courier Services in Kannanur

- International Courier Services in Kottayam

- International Courier Services in Palakad

- International Couirer Services In Madurai

- Courier Services In Karamana -Trivandrum - International & Domastic Courier Services In Karamana -Trivandrum

- Uniex Courier: Reliable International courier in Kerala

- International courier services Palakkad

- International courier services Kilakarai

- Courier Services In Tenkasi - International Courier Services In Tenkasi

- Courier Services In Kovilpatti - International Courier Services In Kovilpatti

- international courier services in Srivilliputhur

- International Courier Service in Pondicherry

- Courier Services In Kumbakonam - International Courier Services In Kumbakonam

- International courier in Arathangi

- International Courier Services In Chidambaram

- International Courier Services in Sattur - Cheapest & Fastest Courier Delivery

- Courier Services in California | Uniex Courier

- Courier Services in Newyork | Uniex Courier

- Uniex Courier & Delivery Services | Courier Services in Washington

- Parcel Delivery Service in Delaware: Pickup & Delivery

- DETROIT Courier & Delivery Services| Uniex courier

- International Courier Services In Tambaram

- International Courier Services In Adyar

- International Courier Service In Madipakkam

- International Courier Services In OMR

- International Courier Service in Old Mahabalipuram

- Australia courier from India chennai tamilnadu

- UK Courier from Chennai & India

- Send Parcels from Chennai to UK

- Privacy Policy

- Courier from India to USA – Compare Rates & Calculate Shipping Cost | Uniex.in

- Medicine Courier Service from Chennai to Usa

- Service

- News

- Contact

- Get Quote

Share This News